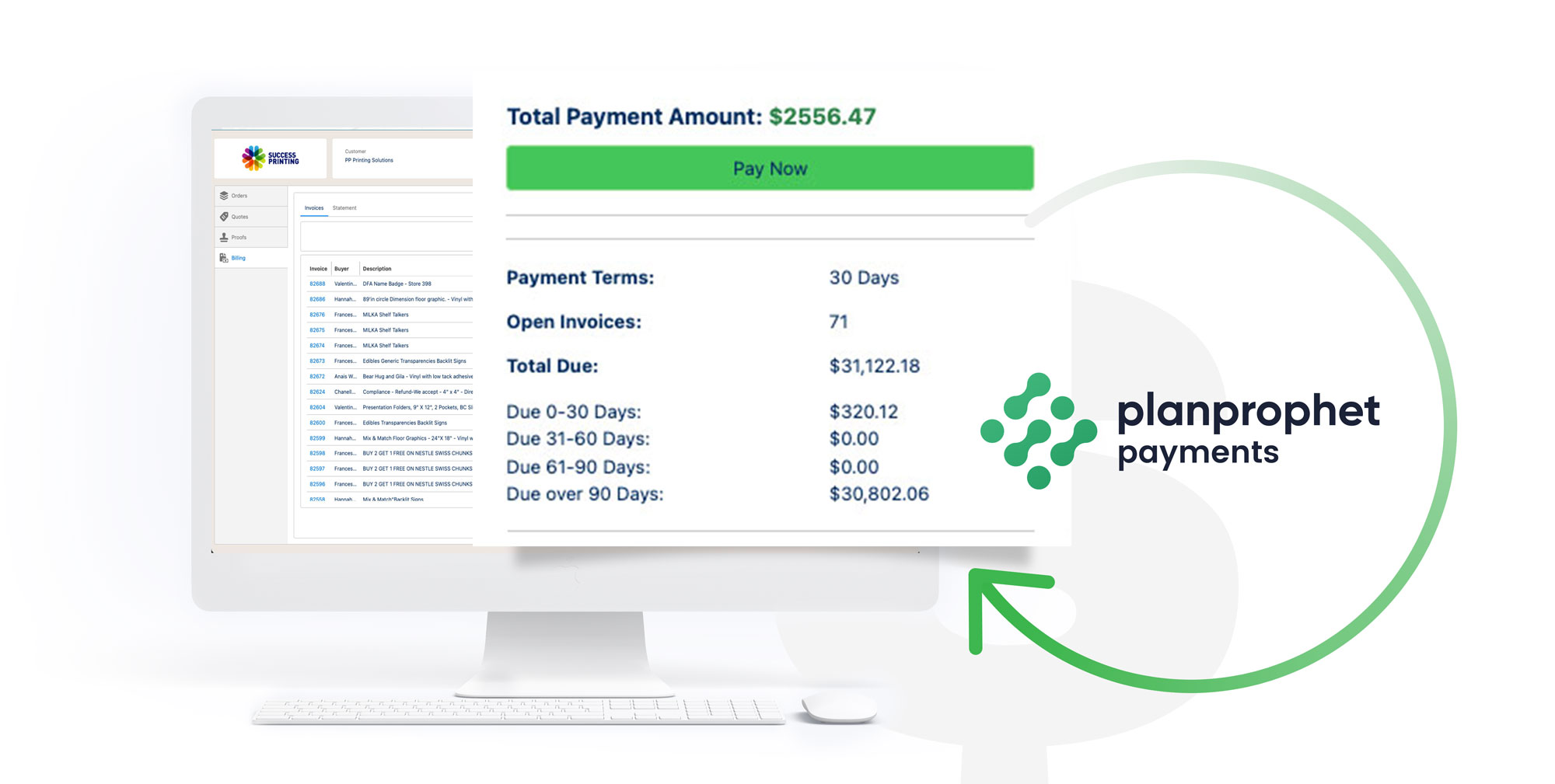

PlanProphet Payments

Streamline your payments. Integrated with the Customer Portal module, it enables batch payments via credit cards or ACH and seamless MIS reconciliation.

Transforming Your Payment Management

In an industry marked by complexity, managing payments has been a persistent challenge for printers worldwide. Recognizing this widespread issue, PlanProphet offers solutions that streamline operations and enhance efficiency. Now, with PlanProphet Payments, we're tackling another critical aspect of your business – the billing process. Gone are the days of manual payment applications and tedious reconciliation efforts. With our payment processing solution, we're empowering printers to take control of their finances effortlessly.

Introducing a Payment Processing Solution

PlanProphet Payments is a comprehensive payment processing solution designed to streamline your business's financial transactions. Seamlessly integrated with PlanProphet Customer Portals, this service empowers your customers to efficiently make and manage their payments, providing convenience for both you and them.

PlanProphet's Payments Key Benefits

Batch Payments

Simplify your payment processes by handling multiple transactions at once. Whether you're processing invoices or receiving payments for services rendered, batch payments ensure efficiency and accuracy.

Accept Various Payment Methods

PlanProphet Payments allows you to accept payments via credit cards and ACH (Automated Clearing House) transactions. This flexibility enables your customers to choose their preferred payment method, enhancing their experience with your business.

Seamless Integration

Our platform seamlessly integrates with PlanProphet Customer Portals, ensuring a smooth and cohesive user experience. Whether your customers are accessing invoices or making payments, the transition is seamless, enhancing satisfaction and loyalty.

Transparent Pricing

At PlanProphet, we believe in transparency. That's why we offer a flat-rate fee structure for both credit card and ACH transactions. With clear pricing, you can easily budget for your payment processing needs without any hidden costs or surprises.

Upgrade Your PlanProphet: Explore Add-Ons!

Did you know you can enhance your PlanProphet experience with exclusive add-ons? Dive into a world of advanced features tailored to boost your productivity. From shipping to seamless integrations, explore the possibilities and customize PlanProphet to match your unique needs.

Empowering Transactions: Run Payments Integration

PlanProphet Payments is powered by Run Payments, a leading payment processing platform trusted by businesses worldwide. Through our partnership with Run Payments, we seamlessly integrate with CardConnect, a renowned provider of secure payment processing solutions. This integration allows us to leverage CardConnect's advanced technology and robust infrastructure to ensure smooth and secure transactions for our customers. With Run Payments and CardConnect, PlanProphet Payments offers a comprehensive payment processing solution, empowering businesses to manage transactions with securely.

Flat Fees for Your Convenience

Acquiring PlanProphet Payments involves no additional cost; you only incur transaction fees associated with processing credit cards and ACH payments. Our flat-rate fee structure ensures clarity and predictability for your financial transactions:

United States

- Credit Card Transactions: 2.75% + $0.15 per transaction (for all credit card brands)

- ACH Transactions: 0.80% + $0.15 per transaction

Canada

- Credit Card Transactions: 2.85% (Visa/MasterCard/Discover) and 3.05% (Amex) + $0.20 per transaction

- ACH Transactions: coming soon

- Please be advised that PlanProphet Payments is not available for American customers using Printer's Plan. Print Reach Pay needs to be use for your payment processing needs instead. For Printer's Plan users in Canada, PlanProphet Payments is available for use.

Automating Writeback to Your Management Information System

With PlanProphet Payments, integration with your Management Information System (MIS) is seamless and effortless. All transactions, whether online or in-store, are recorded alongside detailed transaction information in PlanProphet and can be easily accessed through standard reports and dashboards.

Our automated writeback process ensures that payments are automatically applied to your MIS, minimizing manual intervention and streamlining your workflow. While occasional discrepancies may require manual attention, our platform notifies you promptly, ensuring transparency and efficiency.

For Printer’s Plan users utilizing Print Reach Pay, our integration ensures smooth synchronization of payments, updating order balances automatically. Although batch payments may not support automatic writeback at this stage, PrintReach Pay notifies you via email, allowing for manual association with corresponding orders in your MIS.

Frequently Asked Questions

Review our FAQ responses to better understand everything related to our PlanProphet Payments feature.

PlanProphet Payments is PlanProphet’s merchant services division. It collaborates with PlanProphet Customer Portals to provide an efficient payment solution for your customers. With PlanProphet Payments, customers can batch-pay invoices via credit cards or ACH, with payments seamlessly reconciling with your MIS. PlanProphet Payments requires PlanProphet Customer Portals.

Acquiring PlanProphet Payments involves no additional cost; the sole expense incurred will be the transaction fees associated with processing credit cards and ACH. PlanProphet Payments uses a flat rate structure; see the fees below:

United States:

- Credit Card Transactions: 2.75% + $0.15 transaction fee (for all credit card brands).

- ACH Transactions: 0.80% + $0.15 transaction fee.

Canada:

- Credit Card Transactions: 2.85% (Visa/MasterCard/Discover) and 3.05% (Amex) + $0.20 per transaction

- ACH Transactions: coming soon.

Please be advised that PlanProphet Payments is not available for American customers using Printer’s Plan. Print Reach Pay needs to be used for your payment processing needs instead. For Printer’s Plan users in Canada, PlanProphet Payments is available for use.

To sign-up click here.

The sign-up process for PlanProphet Payments involves four simple steps:

Step 1: Request PlanProphet Payments on the Add-Ons page of PlanProphet website.

Step 2: Our team will send you the merchant application link once we receive your request. Customer will input all the information requested as part of the application.

Step 3: The merchant application will be reviewed by the underwriting team for approval. This process may take between 48 to 72 hours.

Step 4: Once your application is approved, our team will share the onboarding steps.

Currently, the following list of countries is supported, but we will continue working to bring other countries on board:

- USA

- Canada

All the collection of the fees will be managed by Run Payments. Fees are taken out as a chunk the following month, usually between the 2-5th of the month, and would just be deducted from the bank account on file given.

Run Payments is a secure platform used by thousands of merchants across the world and adheres to all PCI Council and Card Brand requirements. If you need a specific document, please let PlanProphet know, and we will request it from the appropriate department. For merchants to maintain their own compliance, they will just have to do an annual assessment through our PCI partner VikingTrust. This will be managed from their account in Sprint as well as the CardPointe gateway.

Money is deposited the next day.

A sample statement can be found here. It shows what the formatting would look like and how a customer could read what they will see.

The statements are shown the 2nd week of the month.

No, PlanProphet Payments requires a special CardPointe account to provide the integration capabilities we support.

You can certainly run both payment processors at the same time; there is no conflict with that. Now, the goal is to facilitate your processes and being able to accommodate all your payment processor needs so you don’t have to be dealing with two different providers.

Any support related to PlanProphet Payment will be handled by your regular PlanProphet support. You can create tickets requesting assistance as you use to do today. We have members on staff that specialize in payments and will be able to answer any questions. Also, as part of our partnership with Run Payments, we have access to their support for additional assistance.

You have the option to define globally a Credit Card and ACH fee that will be applied on top of the total amount pending for payment. At the customer level, you also have the option to override this value. This gives you the flexibility to apply different fees per customer if desired or even charge some and others not. Once the customer is presented with the payment options, a disclaimer will be presented informing them about the fees.

PlanProphet users would never have access to credit card or ACH information. The underlying platform being used to process payments (Run Payments) securely manages this information. Now, through Sprint, which is the payment portal for merchants outside of PlanProphet, only the authorized users would have access to see the tokenized version of the credit card.

There is a new tab in PlanProphet called Payments. In this tab, all the payments that happen through the portal or in-store will be available along with the corresponding transaction information. These records can be accessed using the standard reports and dashboard of PlanProphet and could also be used to create communications.

The writeback process consists of applying these payments automatically to your MIS. There may be occasions where due to certain discrepancies, the payment couldn’t be written back to the MIS and the corresponding users will be notified for manual intervention.

For Printer’s Plan users using PrintReach Pay, the portal will redirect the customers to their payment landing page and through the regular sync process, the order in PlanProphet will get updated with the new balance. For batch payments, the portal will redirect the customers as well to their payment page, but unfortunately, they don’t support at this stage the ability to process multiple payments at the same time and for that reason, there is no automatic writeback to the MIS. In this case, PrintReach Pay will send an email notifying you a payment has been applied for you to manually associate with the corresponding orders in the MIS.

The same processes that happen when done manually would occur in the MIS. PlanProphet is interacting with the MIS via API, and it is the MIS’s responsibility to execute all the processes that usually occur when a payment is applied.

Champion Summit Registration

CoreBridge Software is a dynamic company specializing in providing innovative software solutions to the print, signage, apparel, and similar industries around the globe. With a focus on efficiency and scalability, CoreBridge stands out in the realm of cloud-based systems. Their flagship product, often recognized for its user-friendly interface and robust functionality, streamlines business processes, enhances productivity and enables real-time data access and management.

The company’s mission is to empower organizations to manage and grow their business with simplicity, autonomy, and efficiency, while providing a sense of community and purpose for employees and clients. CoreBridge Software’s commitment to cutting-edge technology and continuous improvement has positioned it as a global leader in its field. Discover more at Corebridge.net

Salesforce is a cloud-based customer relationship management (CRM) platform that helps businesses streamline and automate various aspects of their sales, marketing, and customer service processes. It provides a unified platform for managing customer data, tracking leads, nurturing customer relationships, and facilitating collaboration among teams. With a focus on scalability and customization, Salesforce empowers organizations to enhance productivity, gain insights through analytics, and deliver exceptional customer experiences. Discover more at salesforce.com.

Print Reach’s software suite of well-known products include Midnight MIS, Printer’s Plan MIS, MyOrderDesk, and most recently, Print Reach Pay. With powerful features and rich APIs, their print, mail and web-to-print software allows companies to easily control all facets of their business operations. The long-trusted and revolutionary technology allows companies to leverage their investments to gain a competitive edge and strengthen customer relationships with ease and efficiency. Discover more at printreach.com.

DirectMail2.0, a marketing technology firm, revolutionizes direct mail campaigns with omnichannel marketing and digital platform integration. Partnering with printers, mail service providers, and agencies, DM20 offers 14 integrations that modernize direct mail. They are also launching DM20.ai, an industry-first predictive analytics platform for enhanced omnichannel marketing through machine learning. Founded in 2016, DM20 has processed 1B mail pieces and executed 40,000+ digitally integrated campaigns. Discover more at DM20.com.

JOURNEYS

(DEFINE JOURNEYS IN YOUR CENTER FOR SALES AND PRODUCTION WORKFLOWS)