When you run a business, payments are more than just transactions; they’re the lifeblood of your cash flow, the backbone of your customer experience, and a critical part of your operations. According to a 2024 Deloitte report, businesses that modernize their payment systems see 15–20% faster cash collection and up to 25% fewer failed transactions. The right payments partner can directly influence your bottom line.

But with so many options on the market, how do you know which provider is right for your business? Here are three key factors to consider when evaluating your choices.

1. Transparent & Flexible Pricing

Payments should never feel like a guessing game. Yet hidden fees remain one of the top complaints merchants have with providers, in fact, a survey by The Strawhecker Group found that 34% of small businesses cite unexpected charges as their biggest frustration.

For most companies, what matters most is clarity and consistency; knowing exactly what you’ll pay without surprises. Many providers rely on tiered or interchange-plus models that can look attractive on paper but often leave businesses struggling to predict their true costs. By contrast, flat-rate pricing delivers simplicity in forecasting, fairness across transaction sizes, and complete visibility into every charge.

True transparency goes beyond the rate itself. It includes easy-to-read statements, clear disclosures of fees, and straightforward processes for dispute resolution. And flexibility means being able to offer the payment methods your customers prefer, from credit cards to ACH, without worrying about hidden adjustments or confusing fine print.

The best partners combine clarity with adaptability, giving businesses a pricing structure that’s easy to understand, predictable enough to plan around, and stable enough to scale as you grow.

2. Integration Ease

The average small business spends over 120 hours per year reconciling payments manually (QuickBooks data). If your payment system doesn’t integrate with your CRM, MIS or accounting software, that time investment only grows.

When evaluating partners, consider:

- Do they have pre-built integrations with the tools I already use?

- Will my payment data automatically sync with invoices and customer records?

- Is onboarding simple, or will it take weeks of development?

Seamless integration not only saves time, it also enables better reporting, giving you a clear picture of cash flow, outstanding balances, and customer behavior.

3. Reliable Support

Payments touch every part of your business. When issues arise, like a chargeback or a failed batch, you need answers quickly. Research by J.D. Power shows that payment providers with strong customer support reduce client churn by up to 30%.

That’s why support should be a top priority when choosing a partner. Look for responsive, knowledgeable teams that understand your industry, not just generic help desk scripts.

Where PlanProphet Fits In

At PlanProphet, we designed PlanProphet Payments to match precisely what modern print shops need when choosing a reliable payment partner:

Transparency: Enjoy a flat-rate fee structure for both credit card (U.S.: 2.75% + $0.15; Canada: 2.85–3.05% + $0.20) and ACH transactions (U.S.: 0.80% + $0.15), with no hidden fees or surprises.

Pricing Flexibility: Accept multiple payment methods, including credit cards and ACH, and batch-process payments to fit how your customers prefer to pay.

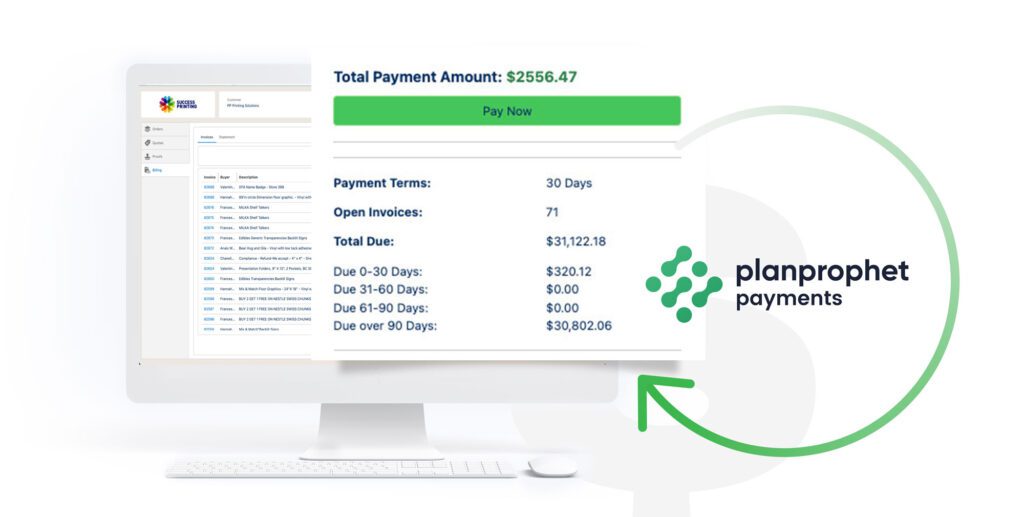

Integration Ease: Seamlessly integrated with the PlanProphet Customer Portal and MIS, payments are automatically written back, keeping quotes, invoices, and payments aligned in one dashboard for streamlined reconciliation.

Reliable Support: PlanProphet Payments delivers secure processing integrated within your PlanProphet environment, supported by the same experienced team you trust for CRM and automation.

PlanProphet Payments isn’t just a processor; it’s built to help print shops get paid faster, reduce manual work, and maintain clarity in billing.

To learn more or see it in action, simply reach out at payments@planprophet.com.